In Munich and Hamburg, old buildings are more expensive than new ones

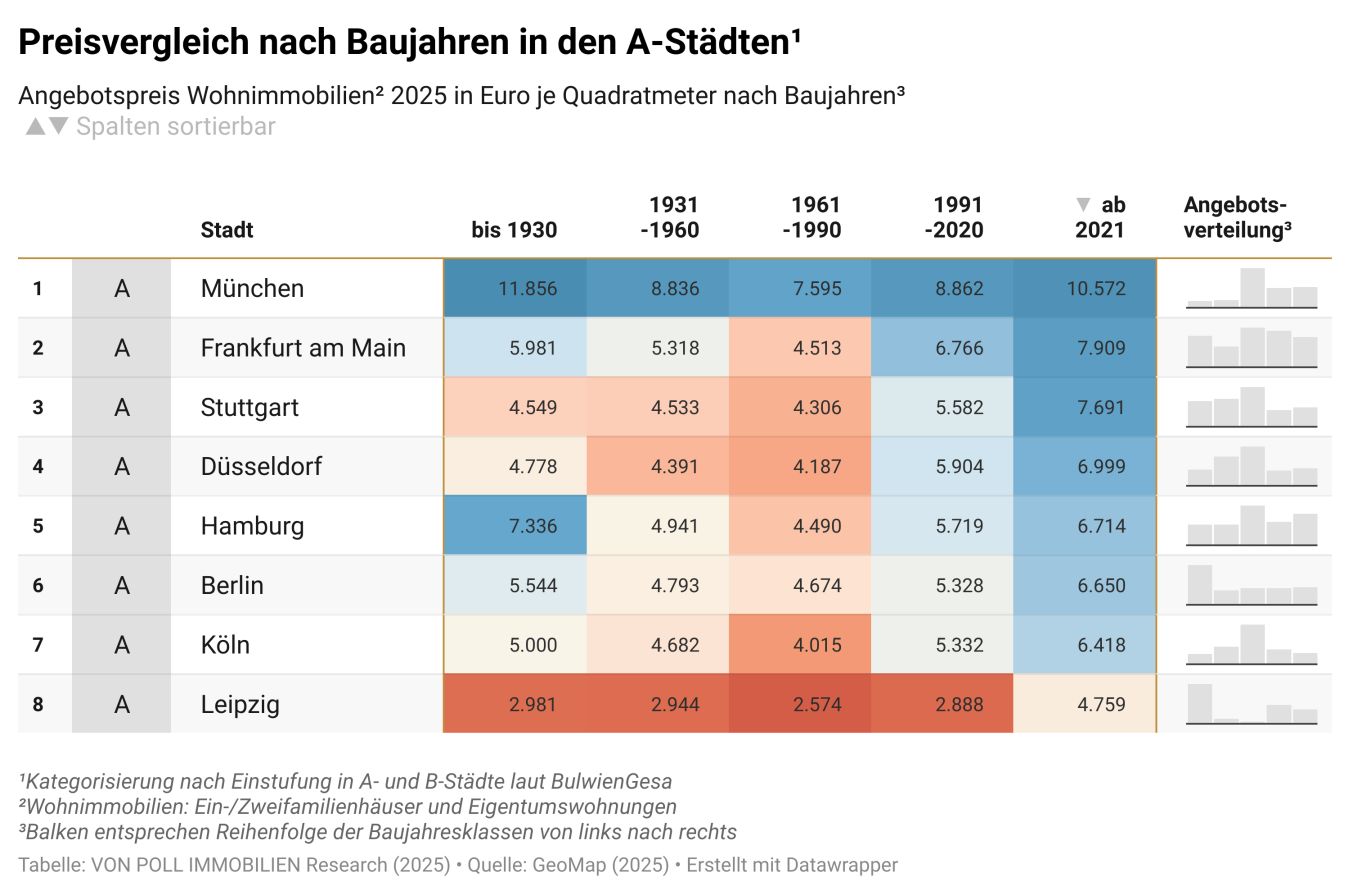

Between old buildings decorated with stucco, the clean lines of the 1960s and the glass façades of new city districts, every building tells of the changes of its time - and of its value. But how much does history cost compared to modernity? How big is the gap between the construction year classes really? The latest VON POLL IMMOBILIEN analysis compares the average asking prices1 for properties according to five defined construction year classes2, clustered up to 1930, from 1931 to 1960, from 1961 to 1990, from 1991 to 2020 and from 2021 onwards, in the eight German A-cities3 - with surprising results. Because the data shows: The price structure has long since ceased to follow the logic of building age alone - it reflects market scarcity, location quality and renovation status.

Munich and Hamburg are the only cities among the eight A-locations in which the average asking prices for old buildings from the period up to 1930 are higher than those for new-build properties from 2021 onwards. In Munich, property prices for historic old buildings reach an average of €11,856/m2, while new builds are priced at €10,572/m2. The picture is similar in Hamburg: Here, the average asking price for old buildings is €7,336/m2 - compared to €6,714/m2 for new builds.

This results in the clearest price gaps within the A-locations in both cities - between the construction year classes up to 1930 and 1931 to 1960. In Munich, prices per square meter from the war and post-war period are on average €3,020 below the prices of historic old buildings, while in Hamburg the difference is as much as €2,395. In contrast, the lowest prices in both cities can be found for properties built between 1961 and 1990 - currently at an average of €7,595/m2 in Munichand €4,490/m2 in Hamburg.

Fig. 1: Price comparison by year of construction in the A-cities, 2025 including the third quarter of 2025 (Graphic: von Poll Immobilien GmbH)

A similar price structure can also be seen in the other A-cities, where properties built between 1961 and 1990 consistently form the cheapest segments of the market. Interestingly, this year-of-construction category accounts for the largest share of supply in almost all A-cities - with the exception of Leipzig and Berlin, where historic old buildings up to 1930 dominate the market and make up the largest share of total supply in the respective metropolis at 50 percent and 38 percent respectively.

While properties between 1961 and 1990 command the lowest prices per square meter, the price difference to the next year of construction between 1991 and 2020 is particularly marked in Frankfurt am Main and Düsseldorf: in the Main metropolis, the price is around €2,253 higher at an average of €6,766/m2, while in Düsseldorf the premium is around €1,717 at an average of €5,904/m2. But even in Cologne and Hamburg, the difference in prices per square meter between these construction year classes is still over €1,000 - in Cologne by €1,317 to an average of €5,332/m2 and in Hamburg with an increase of €1,229 to €5,719/m2.

Fig. 2: Price comparison by year of construction in the A-cities, 2025 including the third quarter of 2025 (Graphic: von Poll Immobilien GmbH)

Equally striking is the price difference for properties built between 1991 and 2020 and new builds from 2021 in Stuttgart, Leipzig, Munich and Berlin. In Stuttgart, the average price per square meter for new builds is currently EUR 7,691 - around EUR 2,109 more than for properties from the previous construction age category. In Leipzig, buyers pay an average of €4,759/m2 for new-build properties, which is €1,871 more than for comparable properties built between 1991 and 2020. In Munich, buyers have to factor in an average of €10,572/m2 for new-build properties - a premium of €1,710 compared to the next most recent construction year category. Finally, in Berlin, prices per square meter for new-build properties are €6,650/m2- an increase of €1,322 compared to properties built between 1991 and 2020.

B-cities follow the trend of A-cities

A look at the B-cities in Germany shows a similar price structure to the A-locations - with the exception of Munich and Hamburg. As expected, new builds from 2021 onwards are the most expensive price category among all construction year classes. Compared to properties built between 1991 and 2020, the price jump for new builds is particularly marked in almost all cities. Properties built between 1961 and 1990 are the cheapest almost everywhere and dominate the property market in almost all cities - only Dresden shows a different picture:

Fig. 3: Price comparison by year of construction in A and B cities, 2025 including the third quarter of 2025 (chart: von Poll Immobilien GmbH)

1 The data basis for the purchase price analysis is based on the average asking prices for detached and semi-detached houses and condominiums from GeoMap for 2025 up to and including the third quarter of 2025.

2 The construction year classes are clustered into five categories according to residential properties built up to 1930, from 1931 to 1960, from 1961 to 1990, from 1991 to 2020 and from 2021 onwards and are based on a classification by VON POLL IMMOBILIEN Research (2025).

3VON POLL IMMOBILIEN uses BulwienGesa's classification of A, B, C and D cities as the basis for categorizing the German real estate market. The cities were grouped according to their functional importance for the international, national, regional or local real estate market. VON POLL IMMOBILIEN also includes Leipzig among the A-cities due to its strong and significant development in recent years.

All data and charts may be used and published with a reference to the following source: von Poll Immobilien GmbH(www.von-poll.com). The chart and the table can be downloaded digitally with an embedding link here:

- Table: https: //www.datawrapper.de/_/tuEYy